Voter Approval Tax Rate Election (VATRE)

The Spring ISD Board of Trustees voted unanimously to include a Voter Approval Tax Rate Election (VATRE) on the upcoming Nov. 5 ballot.

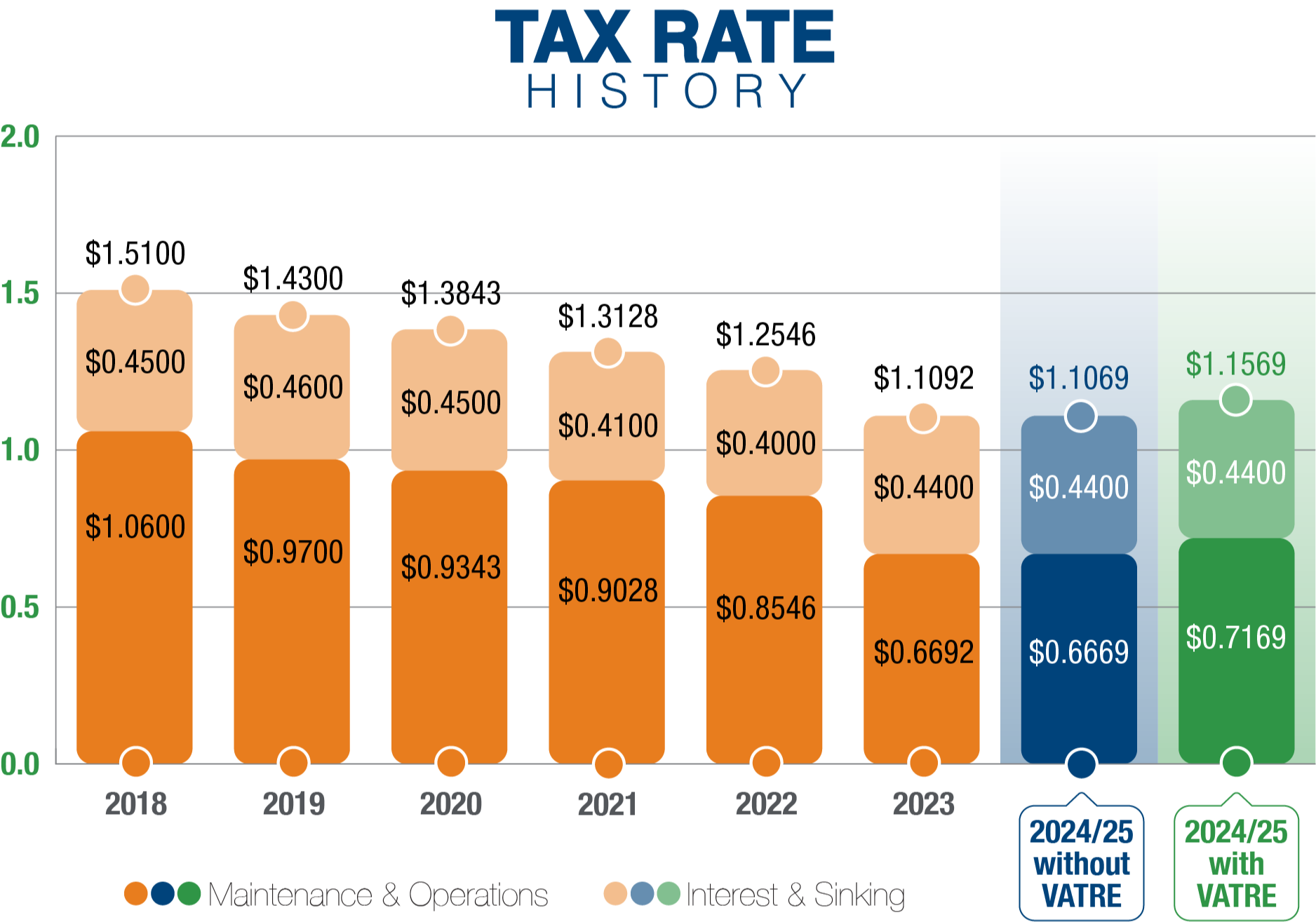

Trustees approved proposing a tax rate of $1.1569 per $100 of property valuation for the 2024 fiscal year, a 5-cent increase from the current rate. If the VATRE passes, that proposed total tax rate would cost a homeowner about $7.00 more per month on a $275,977 house. Homeowners who are receiving a homestead exemption for disability or are age 65 or older would not see an increase above their tax ceiling as a result of the VATRE.

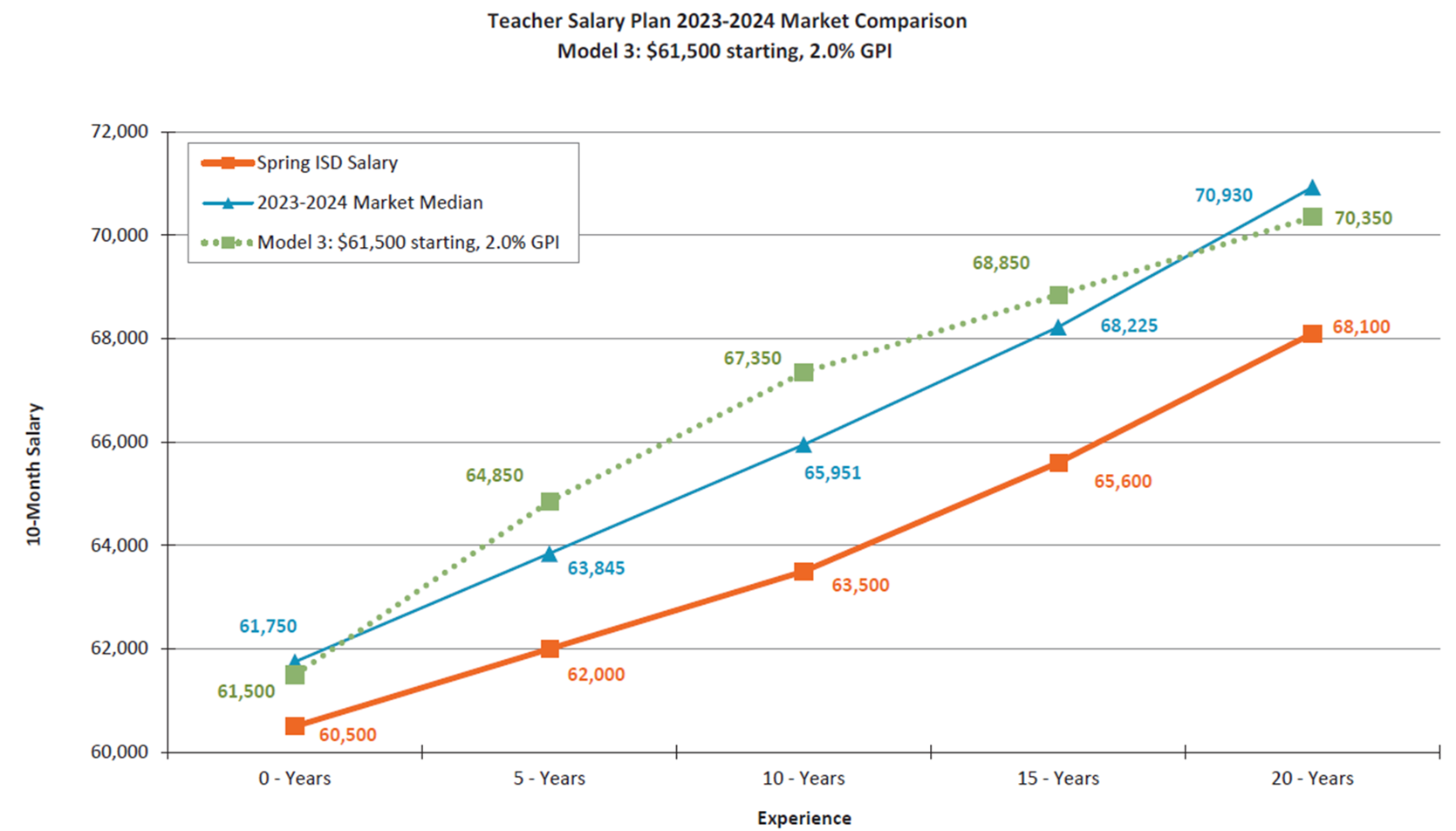

The proposed tax rate, if approved by voters, would provide critical funding for teacher and staff salaries, including a 2% across the board raise for all staff. Starting teacher pay would increase from $60,500 to $61,500 per year, and targeted adjustments would be made for teachers with 5-15 years of experience, putting it in line with other local school districts. Additionally, the district’s remaining budget deficit would be reduced from $12 million to less than $1 million. Read more.

Homeowner Tax Impact

Tax Rate History

Impact on Teacher Salaries